The form is one of the most important Income Tax documents for a taxpayer.

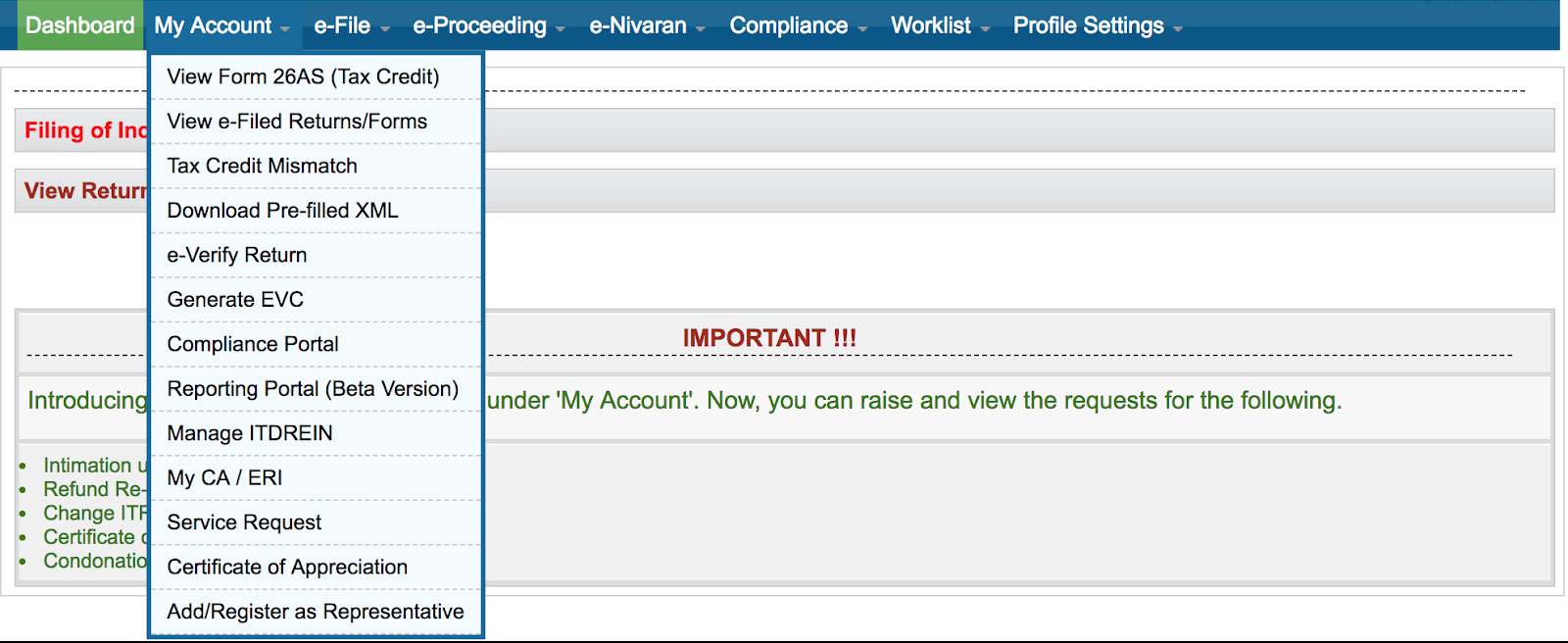

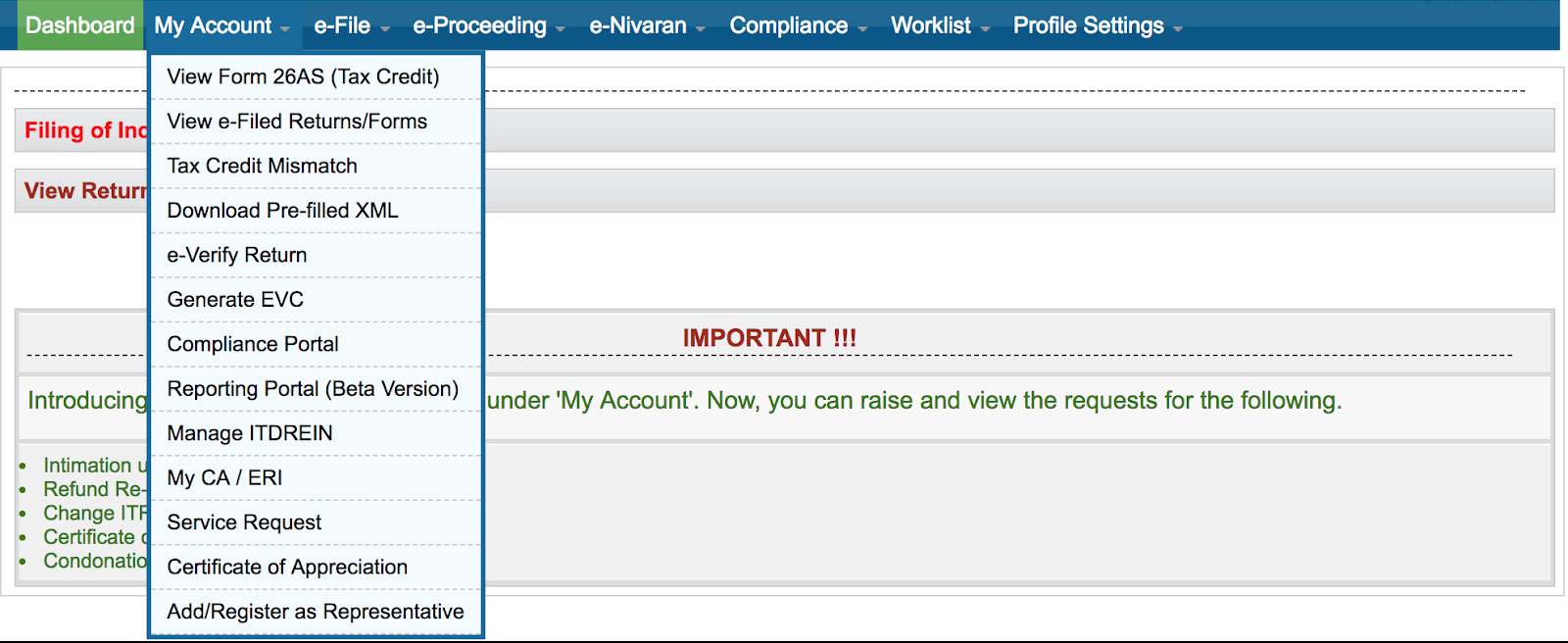

Form 26AS is a consolidated statement issued under Section 203AA of Income Tax Act and rule of 31AB of Income Tax rules to the PAN number holders. Then click on finish & it will be converted to excel.Īlso read: Step-by-Step Guide for E-Verifying Your Income Tax Return Importance of Form 26AS:. Then select other then place ^ in the box then click on next. Then click on delimited & click on next. Then select the entire first column “A” in the worksheet then select the data tab in excel then select option text to column. Paste the selected text in Microsoft excel. Open the downloaded text file & select the complete text & copy. Given below are the various steps to be followed in order to convert the Form 26AS file to excel After clicking on HTML click on save to download it in pdf format. Select the assessment year & method in which you want to download the 26AS i.e., Text or HTML. On the website, an option to proceed will be there, click on the option to view Form 26AS. After clicking on Confirm it will take you to the website of traces. There will be an option for viewing Form 26AS.  After login click on the e-file tab then Income Tax Return. Click on login & enter your PAN (ID) and password. Details of the tax deducted on the sale of real estateĪlso read: How to View & Download Form 26as from The Traces Website?. Information about the income tax refund. Tax details, including advance tax and self-assessment tax paid. Tax is collected at the point of sale (TCS).

After login click on the e-file tab then Income Tax Return. Click on login & enter your PAN (ID) and password. Details of the tax deducted on the sale of real estateĪlso read: How to View & Download Form 26as from The Traces Website?. Information about the income tax refund. Tax details, including advance tax and self-assessment tax paid. Tax is collected at the point of sale (TCS).

Key Components of Form 26AS:įorm 26AS comprises the following components: At the time of submission of income tax return, the taxpayer can claim the benefit of all these taxes already paid by them.ĭid You Know: The Annual Information Statement was launched on November 1, 2021.

It also contains details about the sale and purchase of property, fixed deposits, mutual funds, etc. Form 26AS is a comprehensive yearly tax report that contains information on tax deducted at source, taxes collected at source, self-assessment tax, and advance tax paid by the taxpayer on his/her PAN (Permanent Account Number).

0 kommentar(er)

0 kommentar(er)